Electronic Trading Platforms and Tools

Traders use a combination of several tools in their daily routine. These include charting software, pattern-recognition software, risk-analysis tools, currency converters, simulators, etc. These tools can be used independently or can be integrated into a custom online trading platform to save time and effort.

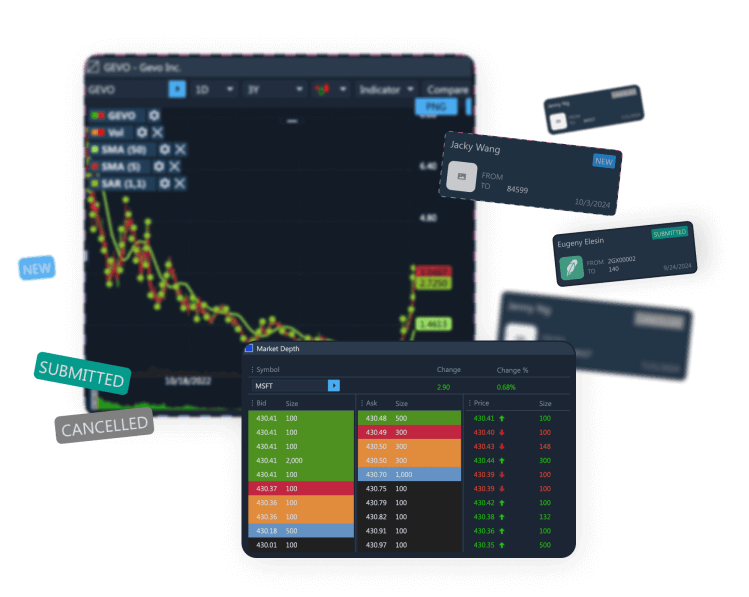

Electronic Trading platforms, such as ETNA Trader, are a more sophisticated type of solution which can be custom built from the ground up to satisfy the needs of the specific broker/dealer or enterprise who will be using it. They are usually complete solutions which can incorporate any tools that the broker wishes to use. Online trading platforms offer the capability to view market prices and issue trades while incorporating many other features. Most trading platforms contain, (at the very least), charting software which can be programmed by the user to specify price, volume, and other deciding factors.

Trading Platforms feature live streaming of up-to-the-minute market data, charts, watchlists, customized alerts, and risk management, among other abilities. These are benefits of custom software development. Trading platforms usually offer more flexibility when it comes to trading several asset classes at once. ETNA Trader is able to trade all asset classes.

Major asset classes include the following:

Platforms are hosted by a server and use the internet. They are software applications which are linked to a database, enabling them to provide price quotes, submit orders, and route orders to an exchange. This can be done in real time for the purposes of scalping or after hours if the data is only being analyzed in order to spot a pattern. Trading platforms save time and money and minimize mistakes because they perform routine tasks automatically and efficiently. They support more users than other solutions we will discuss here. They are necessities for broker/dealers and can be designed to meet the needs of enterprises. For more information about ETNA Trader, click here: https://www.etnasoft.com/etna-trader/

Automated Trading Systems: Trading Robots

Automated Trading Systems are, essentially, robotic systems that trade online. Robots allow the human trader to have more control than a black or grey box would. The Robot can’t do whatever it wants–it has to play by the trader’s rules. The trader sets forth these rules (or parameters) to define how the Robot will make its trading decisions. Have you always wanted to delegate work that you didn’t want to do to your own personal minion? Essentially, that is what employing an ATS accomplishes. The ATS trades systematically based on the criteria you enter. The trader can set the Robot to trade based on the trader’s personal market strategies. The machine does your bidding for you – literally. Trading systems often rely on “watchlists” of certain favored candidates for trades. Robots are capable of issuing trades for stocks, options, futures, forex trading and are capable of scalping. Another advantage of robots is that they can handle extremely high volumes of trades very quickly. Etna Robot, for example, can issue in excess of 3,000 orders per second while experiencing very low latency. For more information about ETNA Robot, click here: https://www.etnasoft.com/digital-advisor/

Advisory Trading Systems

Advisory Trading Systems are just what their name implies: trading systems that advise the trader on which trades to make. They monitor the markets and suggest favorable trades based on parameters which the trader has specified, for example, price. Both Advisory and Automated Trading Systems may also decide when it is not a good time to trade at all if market conditions are too volatile. As with all automated solutions, they are not affected by human weaknesses. Their judgment cannot be compromised by stress or exhaustion. They also don’t have any personal agendas behind their recommendations.

Thinking Inside the Box

Black box trading is another algorithmic solution, also known as “automated trading”. Black boxes are a fixed solution; they arrive virtually ready-to-use and do not accommodate many modifications. They are a “pre-packaged” solution, the trading equivalent of a microwave dinner. The logic these boxes use is fully pre-programmed. The computer acts independently, without human guidance, making decisions based on statistical input about the way the market is behaving.

Black boxes are designed to quickly process and interpret a barrage of data which could not be quickly and easily analyzed by a human. They study the data and make trading decisions accordingly. Black boxes think faster and, therefore, trade faster, save man hours, and base decisions on logic rather than human intuition. If the ATS is a minion, the black box is more like an automatic appliance: it performs the specific tasks it is designed for without personal input or new possibilities.

Black boxes can be vital to making decisions quickly in the fast-paced world of financial markets, where every second counts and vast amounts of money can be made or lost by gaining a few moments’ advantage. Black boxes don’t reveal their secrets they make decisions based on set parameters, but the humans using them rarely know how or why the decisions were made. The black box doesn’t share with you how it made its decision. They are able to trade most asset classes, but they offer far less flexibility than other trading solutions.

Grey boxes also generate trade recommendations through the use of algorithms. But grey boxes are more flexible than black boxes and offer some options for modification. Grey boxes are often more transparent in their decision-making process as well. The idea of a grey box is that the trader can either accept or reject the trade the box recommends, as well as knowing what criteria the algorithm was taking into consideration when it selected that trade. However, grey boxes can still function as fully-automated solutions, just like black boxes, and still offer more insight into how its decisions are made. In the long run, grey boxes can be more profitable than black boxes. Most grey boxes allow the human trader to specify the parameters it will use to choose trades. Because of the time required by human interaction, black boxes can trade faster than grey boxes because they are always running at full automation.

By now, you should have some ideas of what type of solution will work best for your specific needs. But it never hurts to explore your options with an expert by calling ETNA Software at 1-855-779-7171.

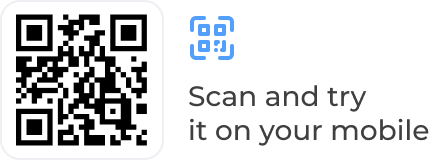

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

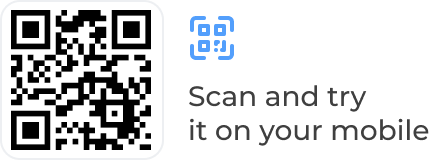

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.