Omnibus Solution for Broker-Dealers

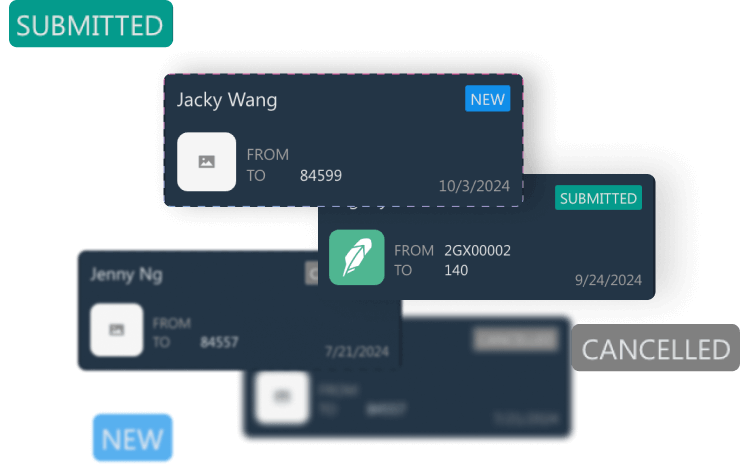

Consolidate client accounts into an omnibus structure

to manage and execute trades on their behalf while maintaining privacy.

Key Advantages of Omnibus Accounts

Account

Consolidation

Combine multiple client transactions into one account to simplify record-keeping and trade execution processes.

Client

Anonymity

Protect client details by withholding them from clearing firms, ensuring privacy and secure operations.

Operational

Efficiency

Manage transactions internally to reduce administrative overhead and improve overall operational efficiency.

Global

Scalability

Support accounts and compliance across regions, ideal for international clients and financial institutions.

Omnibus account use cases for U.S. Market entry

Easily access the U.S. market with omnibus accounts:

- Partner with U.S. brokers to meet SEC requirements and trade with U.S. investors.

- Save costs by reducing custodians and lowering fees for market expansion.

Simplify portfolio management with omnibus accounts:

- Manage portfolios efficiently and reduce time spent on admin tasks.

- Improve risk oversight with consolidated accounts and better portfolio visibility.

Benefits of Omnibus Solutions with ETNA Trader

Security, Data Insights, and Flexibility

Data Security

Reduce the risk of data breaches by keeping individual investor details undisclosed to external parties.

Improved Risk Management

Apply consistent risk controls across all sub-accounts to mitigate exposure.

Flexible Integration

Integrate seamlessly with existing systems and workflows, adding an extra back-office layer within the ETNA Trading Platform.

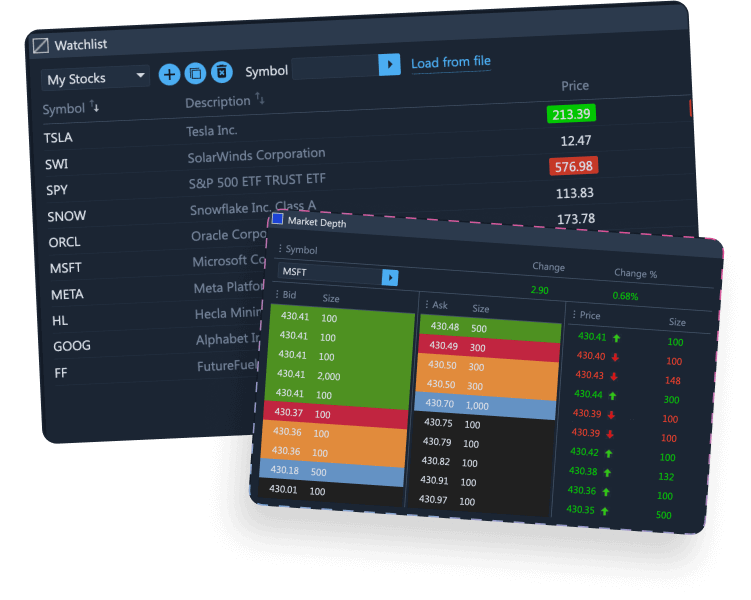

Real-Time Data

Access real-time market data and account information for all sub-accounts instantly.

Customizable Reporting

Generate tailored reports for compliance and clear client communication.

Operational Efficiency and Compliance

Streamlined Operations

Manage multiple accounts through a single interface, reducing administrative overhead and brokerage fees while simplifying tasks.

Bulk Execution/Cost Effective

Execute trades in bulk, reduce transaction costs, and negotiate better exchange rates for client savings.

Enhanced Compliance

Utilize built-in compliance tools to meet U.S. regulatory requirements with ease.

Scalability

Easily handle growth in client base and transaction volumes without compromising efficiency.

Client Privacy

Ensure client privacy by masking individual transactions within the omnibus account.

Why Choose ETNA Trader for Omnibus Accounts?

Simplified Account Management

Consolidate accounts into one structure to reduce workload and improve efficiency.

Cost-Effective U.S. Market Access

Help clients enter the U.S. market with efficient tools and lower operational costs.

Expert Guidance and Compliance

Trust ETNA to navigate legal frameworks and ensure regulatory compliance.