Change is the only constant in today’s world. Technology is evolving, and so are financial markets. Algorithmic trading, mathematical models, and high-speed computers are some of the newest technology advancements that enable accurate and efficient trade execution based on your investing objectives and approach.

This post will discuss algorithmic trading benefits and strategies and how to place “Algo Orders” on ETNA platforms.

Algorithmic trading gives investors—from large institutional players to lone traders—the ability to take advantage of momentary market opportunities and tailor their approaches in a manner that is just not possible given human response rates.

According to recent market research, the global algorithmic trading industry reached a value of USD 15.6 billion in 2023. Furthermore, industry projections indicate that this market is expected to grow at a strong annual rate of 10% from 2024 to 2032, reaching USD 37.6 billion by 2032. This upward trend reflects the increasing integration and adoption of automated trading systems in the financial industry.

Algorithmic trading will give you superpowers to help you achieve your objective more quickly and will simplify your investing path.

High Order Processing Speed

High-speed computers use mathematical models to process your order requirements and market data. They execute trades instantly when they correspond to your requirements, often getting the best stock prices on the market.

Trading Precision

Emotions influence humans. Humans make irrational decisions. In contrast, algorithms conduct transactions using predetermined standards and market data, removing human mistakes and emotional bias.

Lower Stock Prices

Algorithms analyze market data in real-time. They monitor prices and volumes and notice every little price movement. As soon as a favorable price appears, the algorithm instantly executes an order, catching the best price.

Continuous Algorithm Optimization

Developers are fine-tuning algorithms using the backtesting method. They mimic the strategy’s performance under previous market situations using historical market data, price changes, and trading volumes. Testing allows developers to evaluate an algorithm’s performance and identify its strengths and weaknesses for further optimization.

Before choosing an algorithm, define your trading goals.

Consider the following:

If you’re new to trading, consider seeking advice from the broker.

After answering those questions, familiarize yourself with supported trading algorithms:

To offer algorithmic trading, we have partnered with Citadel and SpeedRoute execution venues. To integrate the venue, please get in touch with our support team.

Opening a Trade Ticket with Algo Trading

We’ve detailed how to place an algo order in our Trading Algorithms documentation, but here’s a quick overview:

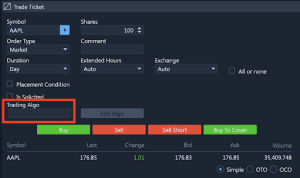

To place an algo order, open a new trade ticket. There will be a “Trading Algo” field.

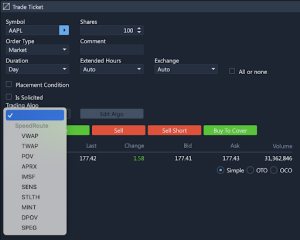

Click on it to select a specific trading algorithm.

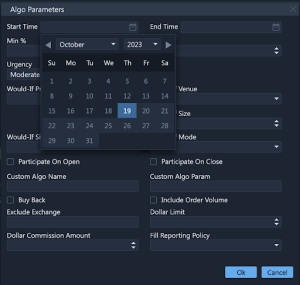

When you select an algorithm within a trade ticket, a pop-up window appears where you should specify algorithm parameters.

We described algorithm parameters in detail in our Trading Algorithms documentation.

When you click “OK,” the platform places a new order; you can find it in your orders on the BO dashboard.

Algorithmic trading blends advanced technology with traditional investment strategies, and ETNA is at the forefront of this evolution. With a variety of algorithms, from VWAP to custom solutions, ETNA makes sophisticated trading accessible to everyone. The platform’s intuitive interface ensures that both institutional and individual traders can efficiently place algo orders, achieving precision and speed. By using ETNA’s capabilities, traders can stay adaptable in a changing market environment and explore new growth opportunities.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.