What is a white label trading software and why the rising number of online broker-dealers and wealth management firms switch to this model?

It’s a lesson that mass-market retailers learned a generation ago: white label products sell.

Grocery stores offer store-branded versions of everything from cereal to pasta sauce for less than the bigger names, consumer electronics retailers sell customers on lower priced generic components, and even small banks are increasingly outsourcing back office functions such as check processing to white label service providers.

In all cases, though, the concept is the same: take a product or service that has been developed by one company and market it under another company’s brand name. For businesses it means they can have a ready-to-use product without investing resources in product development, and for manufacturers or developers it means a new outlet for their product with a ready-made revenue stream.

Even Software-as-a-Service (SaaS) or Infrastructure-as-a-Service products are now offered as white labels. Add a logo, adjust the look and feel and maybe some functions, and here is a ready-made solution to build an audience and market your product or service. This type of arrangement has become common in digital marketing, customer service, market research and other industries in which business-to-business (B2B) software packages are customized and rebranded for more authentic look. FinTech is not an exception. You can get a white label trading software, white label P2P lending platform, white label trading terminals, white label digital advisor and even white label brokerage.

Companies, considering white label software packages, usually want to:

Either way, white label software enables businesses to bring reliability, quality, scalability and efficient operations.

White label trading software for online broker-dealers has emerged as a popular tool for client-facing trading terminals. It enables broker-dealers and FinTech companies to offer their clients a software solution that doesn’t sacrifice anything in the way of features or functionality. This is critical for small and mid-size WealthTech firms and broker-dealers. Firms of smaller size can’t afford having an extensive team of developers with various skills on a payroll. White label software vendors give them an opportunity to stay competitive against the major players and invest more in customer acquisition, customer service and product development.

Truth is technology means a lot when it comes to winning and retaining customers. Over the last decades technology made a giant leap, and it is changing quickly every year. Mobile devices cloud technologies dictate the best practices of commercial software development now. In order to stay competitive and win new clients, broker-dealers have to become tech companies and watch their trading software up to date. This may be costly and very time consuming for a non-expert. The good news is that even early stage FinTech startups can afford to offer their clients a world-class trading experience via using white label trading software.

“Building your own trading and brokerage technology in-house has been increasingly more difficult and expensive over the last several years. Maintaining it and keeping up-to-date is even more resource consuming task. ETNA’s white label software solutions provide versatile, customizable and scalable solutions for digital wealth management firms and online broker-dealers.” – says Roman Zhukov, CEO of ETNA, provider of white label trading platform ETNA Trader. – “We give startups and small businesses tech tools that have been previously only available to larger firms. That boosts the creation of innovative financial products and services for the millions of people around the world.”

White label trading software makes more sense for most brokers than in-house development, according to Drew Gainor with the Young Entrepreneurs Council. Custom-tailored software—while seemingly an ideal solution on paper, allowing the broker to get the exact product they want for their clients—is a time and resource consuming solution on practice. Most of the players in the market can’t afford building software from scratch, and it doesn’t make sense in a highly standardized and regulated industry like FinTech nowadays.

The major cons are:

On the other hand, a white label trading software offers a turnkey solution for brokers looking to get up and running with minimal fuss and downtime. Some of the advantages of the typical white label package include:

White label trading software allows brokers to focus on building their brands and their businesses without spending excessive time and money on software development. What’s more, white label platforms often deliver a better, more sophisticated and flexible product than custom-designed software.

Just as software developers are not all created equal, there are many choices on the market when it comes to white label offerings.

Some products are better suited to trade options, while others are tailored for trading futures. Some white label trading platforms are focused on foreign investors, while others serve U.S. investors only. Be sure you know what you’re getting when choosing white label software or outsourcing any technology development services. Ask questions.

Here are 5 questions you might consider asking when choosing a provider for the white label trading software for your brokerage?

Whether switching to white label trading software from a proprietary platform or shopping for a technology for a startup, using white label trading software is definitely a good strategy. It will save investors money, give access to better tech from day one and overall will shorten your route to market.

ETNA has been developing white label trading software since 2002 and has become an expert in areas like trading, market connectivity, online wealth management, digital onboarding, broker back office and compliance, trade execution and market data. Schedule a free consultation with one of our experts to see how we can help you prosper and grow.

Demo Financial Advisor Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

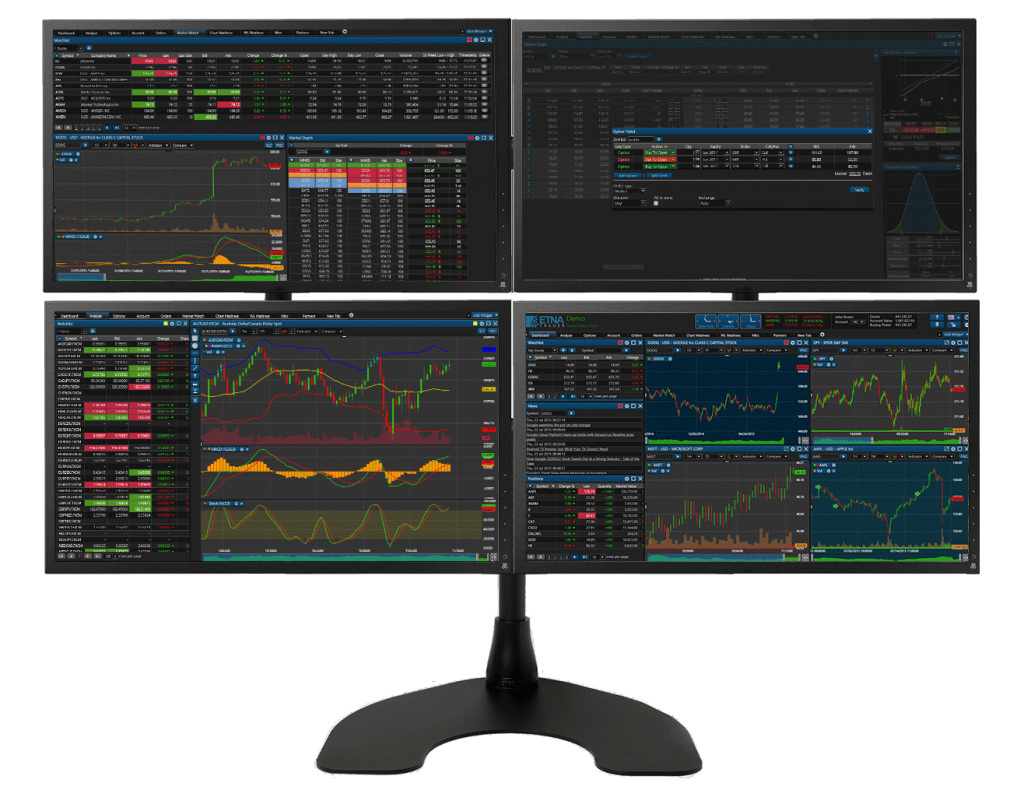

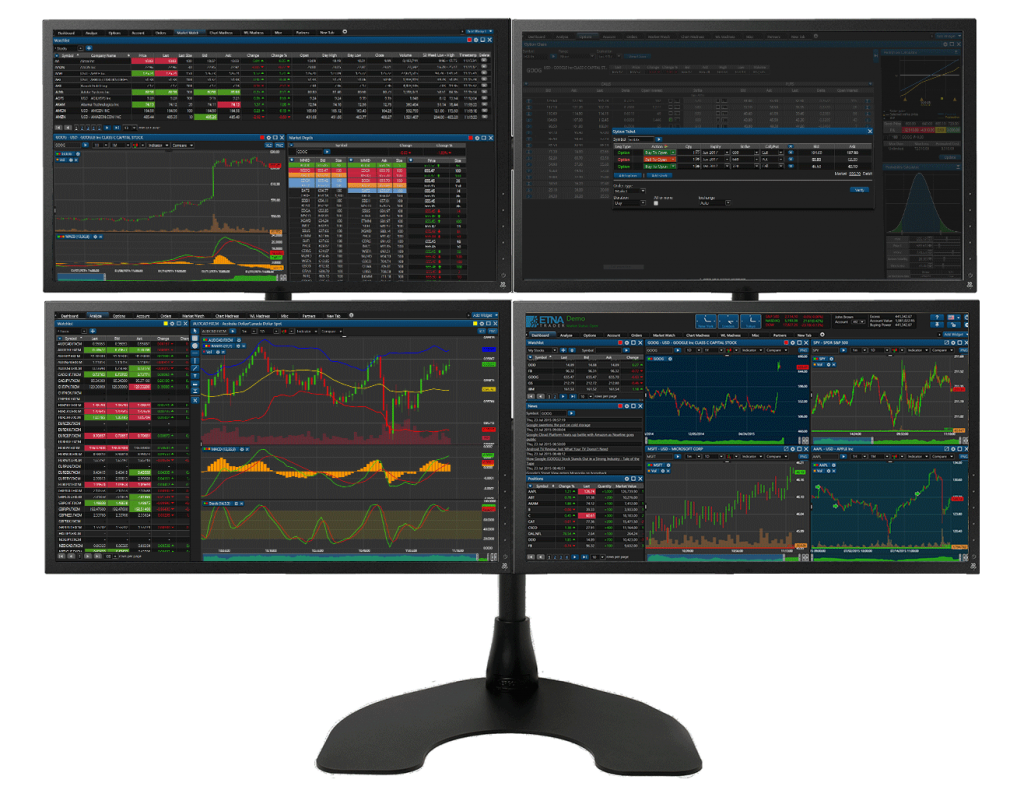

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.